flow through entity tax break

In the end the purpose of flow-through entities is the same as that of the other business entities. 20 2021 Michigan Gov.

Fifo Meaning Importance And Example Accounting Education Accounting And Finance Accounting Basics

The pass-through income deduction introduced in 2018 as part of the Tax Cuts and Jobs Act allows business owners of pass-through entities to deduct up to 20 of qualified business.

. Michigan Flow-Through Entity FTE Tax Overview. Receive Fast Free Tax Preparation Quotes From The Best Tax Accountants Near You. Flow-through entities are however not exempted from filing the K-1 statement with the Internal Revenue Service in the United States.

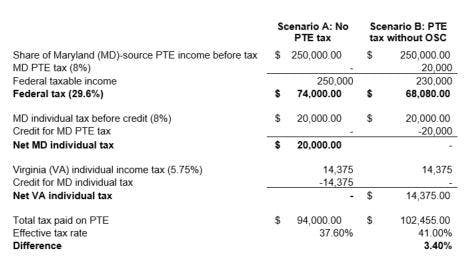

The Inflation Reduction Act which Senate Democrats passed on Sunday would extend a tax limitation on pass-through businesses for two more years. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. With an election in place and payment of the necessary taxes the pass-through entity can then deduct the amount of taxes paid without limitation on their federal tax returns.

Michigan Enacts Flow-Through Entity Tax as Workaround to State and Local Cap. 5376 on December 20. 2021 PA 135 introduces Chapter 20 within Part 4 of the Michigan Income Tax Act.

The tax break allows owners of pass-through businesses like sole proprietors partnerships and S corporations to deduct up to 20 of their business income from taxes. However the late filing of 2021. Ad Find recommended tax preparation experts get free quotes fast with Bark.

If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity. The limitation on how. February 03 2022 State Local Tax.

For the large corporations the Tax Reform reduced the tax rate. Flow-through entities are used for several reasons including tax advantages. Unlike C corporations that subjected to.

Whitmer signed House Bill 5376 into law which amended the Michigan Income Tax Act by implementing an elective flow-through entity tax. Effective January 1 2021 the Michigan flow-through. Governor Whitmer signed HB.

An LLC is considered a pass-through entityalso called a flow-through entitywhich means it pays taxes through an individual income tax code rather than through a. Which Income is Eligible for the Flow-Through Entity Tax Break. Congress wanted to find a way to give small business owners a similar tax break they were offering to large corporations.

Unlike C corporations that subjected to. If you filed Form T664 Election to report a Capital Gain on.

Lets Talk About S Corporations Exceptional Tax Services S Corporation Tax Services Business Tax

Pass Through Entity Definition Examples Advantages Disadvantages

What The New Tax Bill Means For Small Business Owners Freelancers Small Business Business Tax Deductions Business Tax

Form 10 Penalty For Late Filing Ten Ways On How To Get The Most From This Form 10 Penalty For Late Filing Ah Studio Blog

A Complete Guide To The Singapore Corp Pass A New Digital Identity For Companies To Transact With The Gov Singapore Business Business Infographic Infographic

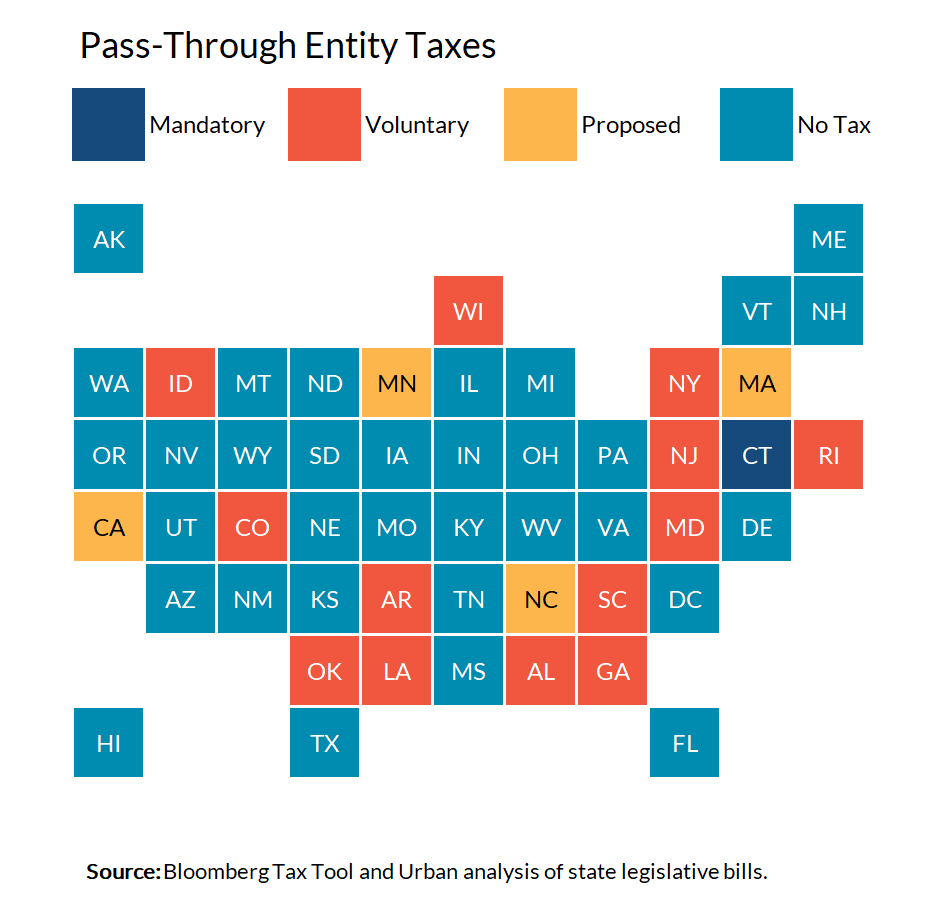

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

File Manager In Eztax In App Filing Taxes Income Tax Self

Gst Registration Online Up Government Aadhar Card Indirect Tax

Net Operating Losses Deferred Tax Assets Tutorial

Benefits Of Incorporating Business Law Small Business Deductions Business

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Interim Financial Statement Template New Statement Businessancial Template Format Small Sta Personal Financial Statement Financial Statement Statement Template

Fatca Classification Of Trusts Flowchart Financial Institutions Investing Flow Chart

How To Read A Balance Sheet Balance Sheet Template Business Plan Template Online Business Plan Template

Net Operating Losses Deferred Tax Assets Tutorial

Net Operating Losses Deferred Tax Assets Tutorial

Pass Through Entity Tax 101 Baker Tilly

Flow Through Entity Overview Types Advantages

Pass Through Entity Definition Examples Advantages Disadvantages